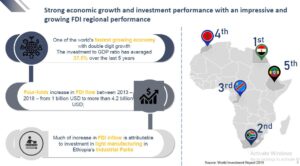

With a GDP growth rate of 11% for more than a decade, Ethiopia is one the fastest growing economies in Africa and the world. Although, Ethiopia experienced a high rate of growth in investment over these years domestic savings were not able to satisfy the domestic investment demand causing a large investment-savings imbalance. To remedy these and other macroeconomic imbalances the Ethiopian Government implemented the Home-Grown Economic Reform Program in 2019. This reform program had the central objective of sustaining rapid growth, maintaining stable macroeconomic environment by reducing debt vulnerabilities and creating adequate and sustainable job opportunities. At the end of this restructuring through the Home-Grown Economic Reform Program, the Government launched the Ten-Year Development Plan that aims to make Ethiopia: An African Beacon of Prosperity by 2030. The plan aims to have an average of 10% growth of GDP over the 10 years with a 5.9 %, 13 % and 10.6 % average growth in agriculture, industry and services sector. This new development plan gives ample attention to the role of private sector and its investment as a catalyst for more high-quality growth and aims to provide structural reforms to create a more favorable investment environment for companies especially from China.

Chinese investment in Ethiopia

One of the most important mainstays in the Ethiopian Economy these past years has been the ever-growing investments from Chinese companies in Ethiopia. The Ethiopian Government attaches great importance to its relations with China. At present, the two countries have upgraded their diplomatic relations to the level of ‘Comprehensive Strategic Partnership’ and are cooperating together to create a better and a mutually beneficial relationship.

The Initiatives of ‘the Belt and Road’ proposed by President Xi Jinping has received a positive response from Ethiopia. ‘The Belt and Road’ has become a concrete practice for building a community of shared future for mankind. the comprehensive win-win partnership and cooperation between Ethiopia and China anchored on FOCAC has become the model for an effective and successful Sino – Africa as well as South-South cooperation. Sino-Ethiopia effective partnership has also started paying its dividends to China’s private companies and state-owned enterprises that have taken an initiative to take part in the Ethiopia’s transformative journey.

Since the establishment of the Eastern Industrial Park, the first Industrial Park in Ethiopia Chinese enterprises have taken commendable steps in investing and creating jobs in Ethiopia. The successes of companies such as Huajian or more recently BGI Health in investing in Ethiopia showed the immense opportunities that exist in Ethiopia.

Currently, the tremendous efforts by the Chinese Government and its people China have managed to contain the COVID19 pandemic, and having its trade and investment activities recover gradually, meanwhile, the pandemic has also created a massive opportunity for Chinese investors to take further steps on outbound investment, like cashless payment technologies and medical supplies.

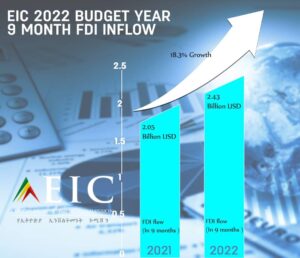

On the other hand, despite the disruptions created by the pandemic on the global economy and internal conflict FDI in Ethiopia in the past 9 months registered an 18.3 % growth in 2022 compared to the same period last year reaching from 2.05 billion USD in 2021 to 2.43 billion USD in 2022. Manufacturing drew a large percent of FDI during this period. Nowadays, about two-thirds of all Chinese firms in Ethiopia were engaged in the manufacturing sector, twice the average of Chinese firms’ engagement in Africa and shows the enduring confidence of investors in the Ethiopian market and potentials.

In terms of factor endowments, Ethiopia has a relatively large, youthful population of about 110 million people and comparatively few fossil fuels and mineral resources. At present, Ethiopia’s rural population share is 80 %, similar to China’s at the start of China’s reform and opening in 1978, suggesting strong potential for structural transformation through shifting labor from agriculture to industry. Taken altogether, these factors suggest that Ethiopia has the potential to become the next destination for labor intensive industries as wages rises in countries like China and Vietnam.

For many Chinese first-generation industries in areas such as textile and garment, agro-processing and light manufacturing, Ethiopia represents an ideal destination to relocate their manufacturing installations or start similar industries afresh by capitalizing on the abundance of inexpensive and easily trainable semi-skilled labor and low-cost of electricity. Due to forward looking reforms by the Ethiopian Government, nowadays, new focus sectors such as mining, pharmaceuticals and tourism present a plethora of opportunities for Chinese investors.

Priority sectors and Incentives for Investors

Agriculture, Manufacturing and Mining are the focus areas in productive sectors of the economy recognized as levers of further economy growth in the coming years, while the tourism sector has been recognized as a lever of growth from the service sector. Similarly, the development of the energy, transport, sustainable finance, innovation and technology, urban development, irrigation, human capital development are enabling sectors given due attention in the plan and by the Government of Ethiopia.

These sectors are open for Foreign Direct Investment and receive competitive and comprehensive set of incentives such as:

- Customs duty payment exemption on capital goods and construction materials, and on spare parts whose value is not greater than 15% of the imported capital goods’ total value.

- Investors have the right to ask a refund of customs duty paid on inputs (raw materials and components) when buying capital goods or construction materials from local manufacturing industries.

- Income tax exemption of up to 6 years for manufacturing and aAgro-processing, and up to 9 years for agricultural investment.

- Additional 2-4 years income tax exemption for exporting investors located within industrial parks and 10-15 years exemption for industrial park developers.

- Carry forward of losses for half of the tax holiday period.

- Several export incentives, including the Duty Draw-Back, Voucher, Bonded Factory, and Manufacturing Warehouse, and Export Credit Guarantee schemes.

- In addition, the government guarantees the remittance of profit, dividends, principals, and interest payments on external loans, and the provision of land at competitive lease prices.

These wide-ranging incentives packages for priority sectors and export-oriented investments show a High-level political commitment for investment promotion and protection that can be seen especially as Investment policy-making is led by the Ethiopian Investment Board and chaired by the Prime Minister.