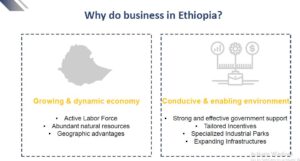

Why invest in Ethiopia?

One of the most important aspects in the Ethiopian Economy over the years has been the ever-growing investments from Chinese companies in Ethiopia. The Ethiopian Government attaches great importance to its relations with China. At present, the two countries have upgraded their diplomatic relations to the level of Comprehensive Strategic Cooperative Partnership (CSCP) and are cooperating together to create a better and a mutually beneficial relationship.

The Belt and Road Initiative (BRI) has become a concrete practice for building a community of shared future for mankind and it has received an enormous positive response from Ethiopia. The comprehensive win-win partnership and cooperation between Ethiopia and China anchored on the Forum on China Africa Forum (FOCAC) has become the model for an effective and successful Sino – Africa as well as South-South cooperation. Sino-Ethiopia effective partnership has also started paying its dividends to China’s private companies and state-owned enterprises that have taken an initiative to take part in Ethiopia’s transformative journey. Since the establishment of the Eastern Industrial Park – the first Industrial Park in Ethiopia, Chinese enterprises have taken commendable steps in investing and creating jobs in the country. And the successes of several reputable Chinese companies in investing in Ethiopia, shows the immense opportunities that exist in Ethiopia.

Nowadays, about two-thirds of all Chinese firms in Ethiopia are engaged in the manufacturing sector, twice the average of Chinese firms’ engagement in Africa and which again shows the enduring confidence of investors in the Ethiopian market and potentials.

For many Chinese first-generation industries in areas such as textile and apparel, Agro-processing and light manufacturing, Ethiopia represents an ideal destination to relocate their manufacturing installations or start similar industries afresh by capitalizing on the abundance of inexpensive and easily trainable work force and low-cost electricity. Furthermore, new priority sectors such as mining, pharmaceuticals and tourism present huge opportunities for Chinese investors.

Reserved for Joint Investment with Government

Manufacturing of weapons, ammunition and explosives

Import & export of electrical energy

International air transport services

Bus rapid transit

Postal services excluding courier services

Joint Investment with Domestic Investors

Freight forwarding and shipping agency services

Domestic air transport service

Cross-country public transport service (seating capacity >45)

Urban mass transport service (large carrying capacity)

Advertisement and promotion services

Audiovisual services – Motion picture and video recording, production and distribution

Accounting and Auditing services

Note: Foreign investor share capital not more than 49%

Reserved for Domestic Investors

Banking, insurance & microfinance excl. capital goods finance business

Whole sale trade – petroleum & products wholesale of own products excluding whole of electronic commerce

Retail trade excl. retail of electronic commerce

Import trade excl. liquefied petroleum gas and bitumen

Export trade of raw coffee, khat, oil seeds, pulses, minerals, hides &skins, products of natural forest, chicken & livestock

Hotel, lodge, resort, motel, guesthouse & pension service excl. star-designated

Travel agency, travel ticket sales & trade auxiliary, tour operation

Operating lease of equipment, machineries & vehicles excluding industry specific

Transport services excl Railway, cable-car, cold-chain, freight transport